Overview:

In today’s fast-paced financial markets, misinformation and rumours can severely impact stock prices and investor confidence. SEBI’s Listing Obligations and Disclosure Requirements (LODR) Regulation 30(11) mandates listed companies to promptly respond to rumours or unverified reports that could materially affect their securities. proCS SEBI Rumour Management Software is a cutting-edge, AI-powered solution designed to help companies efficiently monitor, identify, and respond to market rumours in full compliance with SEBI regulatory requirements.

-

Key Features:

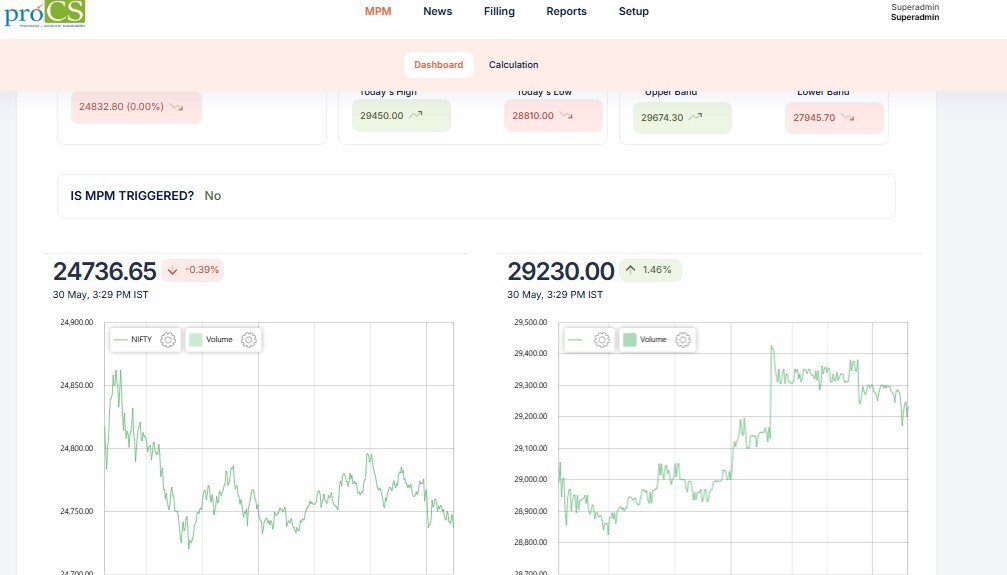

- Real-time Rumour Detection: Utilizes Real time NSE/BSE data feed and AI continuously scan stock market, news in mainstream media and social media handles for any mention of your company or related keywords

- Automated Alerts & Notifications:: Instantly alerts compliance officers and communication teams upon detecting potentially market-movement beyond threshold and rumours or unverified information in the mainstream media.

- Centralized Dashboard: Provides a consolidated view of all rumours, their sources, to prioritize response actions.

- Regulation 30(11) Response Workflow: Built-in compliance reporting template to streamline the process to draft, review, and issue clarifications or rebuttals to rumours, ensuring timely disclosures within the stipulated timeframe.

- Audit Trail & Reporting:: Maintains a detailed record of all detected rumours, internal actions taken, and official communications issued — crucial for SEBI audits and corporate governance documentation.

-

Why Choose Our Software?

- Regulatory Compliance Made Easy: Designed specifically around SEBI’s LODR Regulation 30(11), reducing the risk of penalties for delayed or improper disclosures.

- Protect Market Integrity:: Prevents misinformation from affecting share prices by enabling quick and accurate company responses.

- Enhance Investor Confidence: Transparent, timely communication reinforces trust with investors and market participants.

- User-Friendly Interface:: Intuitive dashboards and alerts ensure that your compliance and communication teams can act swiftly and effectively.

-

About LODR Regulation 30(11):

SEBI’s LODR Regulation 30(11) requires listed entities to make prompt disclosures when rumours or media reports related to the company’s securities or operations come to their notice and could potentially impact share prices. Companies must verify such information and publish clarifications within a prescribed timeframe to maintain market integrity.

-

Get Started Today

Ensure your company stays ahead in managing market rumours with our comprehensive SEBI Rumour Management Software. Contact us for a demo or consultation to see how our solution can safeguard your compliance and corporate reputation.