Structural Digital Database Software

As per the latest SEBI PIT Compliance

1. Overview

In today’s fast-evolving capital markets, ensuring strict compliance with SEBI’s Prohibition of Insider Trading (PIT) Regulations is critical to uphold market integrity and protect stakeholders. Our Structural Digital Database Software offers a robust, secure, and scalable platform that helps organizations effectively manage insider information, monitor trading activities, and generate compliance reports — all in one unified system.

2. Key Features

Centralized Data Repository

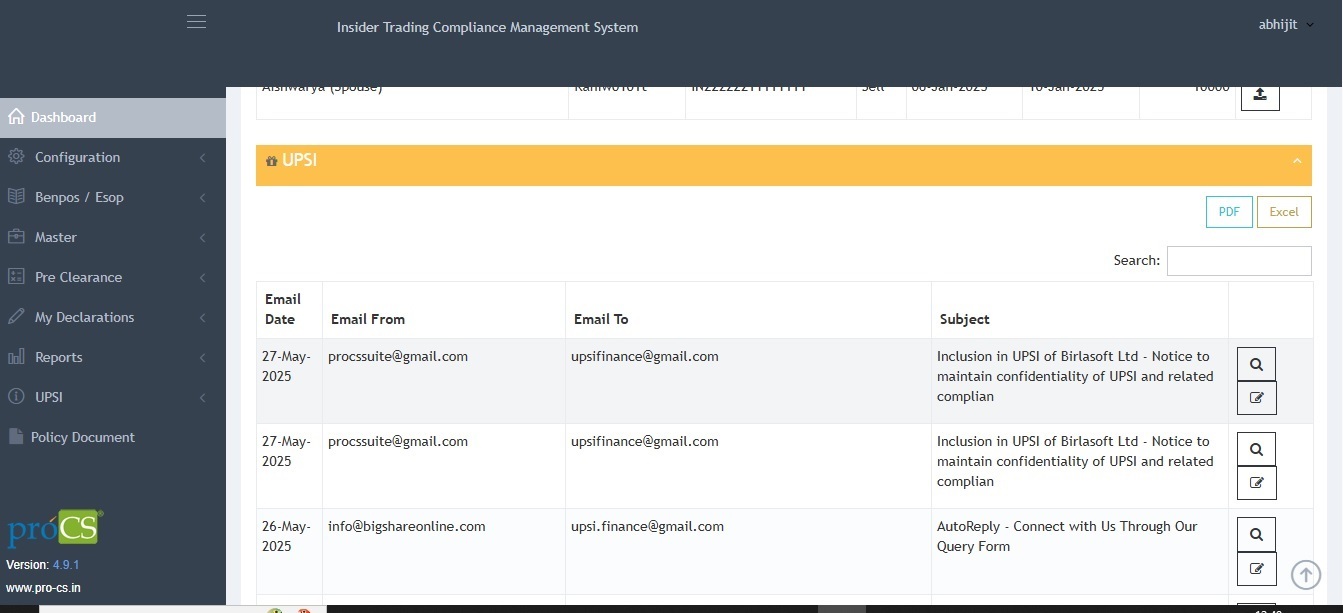

- Securely store all UPSI (Unpublished Price Sensitive Information) in non-temperable structured digital database.

- Maintain a historical log for audit and compliance verification.

Role-Based Access Control

- Granular access permissions to ensure that only authorized personnel can view or modify sensitive information.

- Dynamic user roles aligned with SEBI guidelines.

Automated Compliance Workflows

- Capture UPSI data via e-mails in an automated manner (No manual entry required)

- Automated alerts for blackout periods and trading restrictions.

Real-time capturing of UPSI

- Instant capturing of UPSI data via e-mails. No non-compliance due to delayed entries.

Comprehensive Audit Trail & Reporting

- Detailed logs of all the captures UPSI

- Ready-to-use compliance reports tailored to SEBI PIT requirements.

- Exportable reports for internal audits and regulatory submissions.

Integration Capabilities

- Seamless integration with existing ERP, HRMS, and trading platforms.

- API support for custom workflows and data exchange.

Data Encryption & Security

- End-to-end encryption to protect sensitive data at rest and in transit.

- Compliance with industry-standard security protocols and SEBI guidelines.

3. How It Works:

- Data Capture: Capturing of UPSI data via email automation, manual entries and through excel templates.

- Access Management: Assign user roles based on hierarchy and compliance needs.

- Monitoring & Alerts: Detect and report suspicious activities in real-time.

- Reporting: Generate detailed audit reports and submit to regulators as required.